*Updated for 2023*

Our Top-up insurance is an industry leading, cost-effective way to protect yourself from damages that may happen to your hire car.

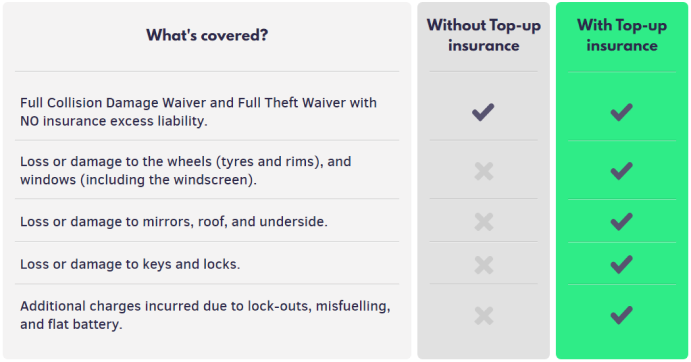

Most car hires without any added protection only come with CDW, more on that here. While this is better than being liable for the entire value of the car, it doesn’t always cover damage you may cause. Our standard Excess Reimbursement Insurance does cover collision damage, but our Top-up insurance fills gaps and covers you for much more.

What is Zest’s Top-up insurance?

Our Top-up insurance is the top level of cover available provided by us! You’ll receive reimbursement cover against loss or damage to the vehicle not covered by the standard car hire insurance.

What’s covered by Top-up insurance:

Here’s a list of the most areas covered by our Top-up insurance that wouldn’t come under normal CDW coverage.

- Damage to the wheels or tyres

- Glass damage

- Damage to the underside of the car

- Roof damage

- Losing or breaking the car keys

- Mis-fuelling

- Being locked out of the car

- Battery failures

- Mobile phone call charges

- Car theft

- Road rage incidents

– Top-up insurance, however, will not cover damages made to the rental vehicle’s interior.

A quick note: Insurance is complicated. These items listed are covered under normal conditions where you’re still following the terms and conditions of the insurance.

You’ll be unable to claim for something if it comes to light that you weren’t following the terms or were negligent.

For example:

- The underside of the car was damaged while you were driving off-road

- You badly damaged a wheel while driving over the alcohol limit

How is Top-up insurance different to what the car hire provider offers me?

It depends on the providers exact product, but in general, our Top-up insurance is cheaper than the provider’s cover, and you do still need to pay for damage, but you can claim these charges back under the insurance policy.

One other difference is that many providers offer their own protection as a way to remove the requirement for a security deposit when collecting the car. As our Top-up insurance is taken with us and not the provider, you’ll still have to leave a security deposit. For more information on security deposits read our car hire security deposits explained blog.

If you take our Top-up insurance and damage the vehicle, you’ll still need to pay the rental provider for the damage. However, you can claim this back when you return, luckily, claiming is quick and easy.

What is the Top-up insurance claims procedure?

In the event that you need to make a claim on your Top-up insurance, you can do this by following the instructions set out on your policy wording document. This is quick and easy process and most claims are handled within 7 days but it can take up to 30 days.

All set? Book your car hire below

Don’t forget to add Top-up insurance for more peace of mind with your car rental! Still have more questions about car rental insurance? Read our Complete Car Hire Insurance Guide.